How does Clover Hospitality by BentoBox calculate tax?

Calculates sales tax for your business automatically using a third-party service called TaxJar. Click here to view Sales Tax Calculator.

Taxes are calculated differently in each state, city, and municipality. Your business may be required to collect tax, depending on your state, the method of sale, the goods you’re selling and the location of your business and/or employees. The effective tax rate is calculated using what is called a “nexus,” which considers the location where goods/services originated and location where they are rendered.

You can learn more about how your state’s rules and calculation of taxes here.

Sales Tax Product Categories:

Clover Hospitality by BentoBox will auto-generate your tax rates (through TaxJar) for the following categories:

General Taxed Items

Clothing

Food & Groceries (Unprepared)

Prepared Foods (On-Site Consumption)

Books

Magazines (Individual)

Magazines (Subscription)

Bread and Flour Products

Coffee, Coffee Substitutes and Tea

Beer/Malt Beverages

Wine

Liquor/Spirits

Tax Exempt

Does TaxJar collect sales tax for me?

While TaxJar helps you ensure you're collecting the proper amount of sales tax on your orders by offering Reporting and Calculation services, this service does not collect and hold the sales tax for you.

For more information, click here.

How does Clover Hospitality by BentoBox know which taxes to calculate from my eCommerce store orders?

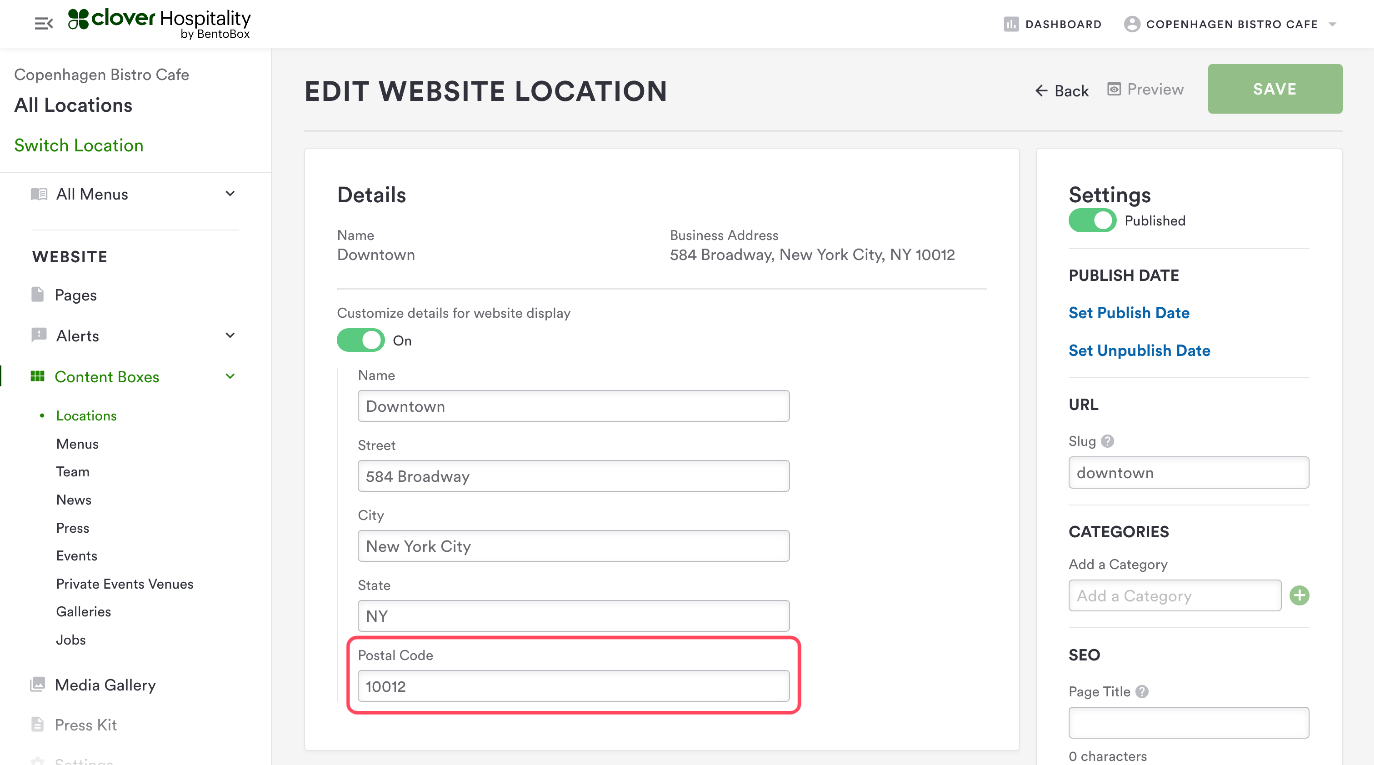

We use the Location Details in your locations box settings to auto-calculate the tax of an order.

The API will automatically calculate the sales tax you should collect for states you've enabled as nexus states in your Location Box and Sales Tax Settings.

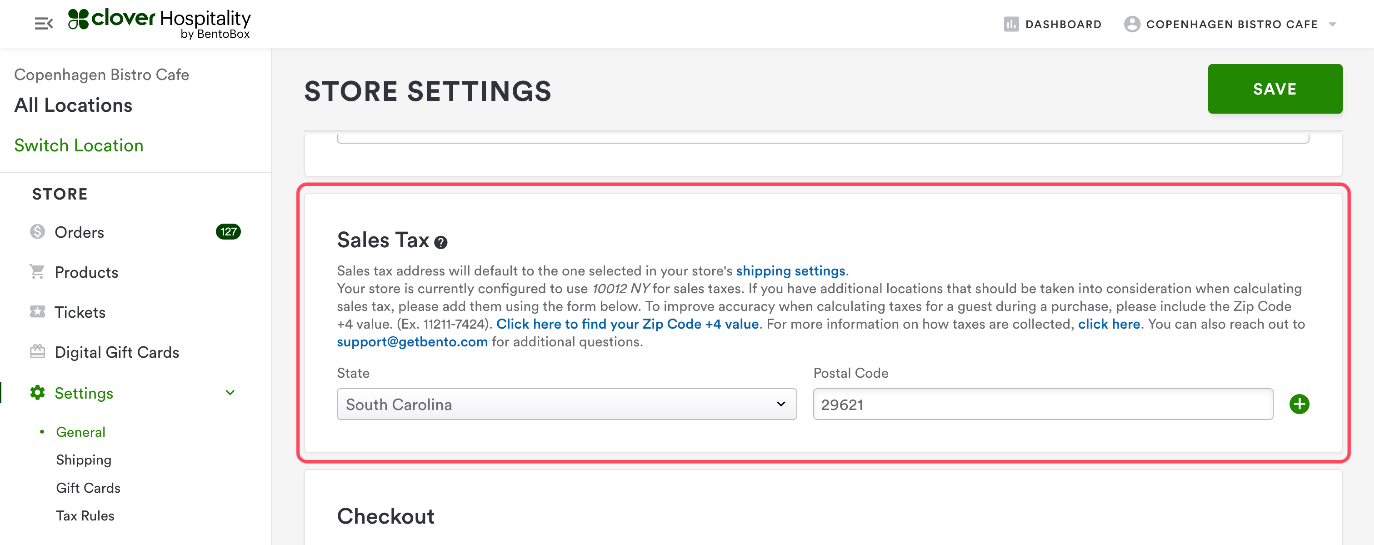

What if I want to collect taxes from an out-of-state address?

In most cases, you should really only collect taxes if you have a physical presence in that State. If you do have more than one location, you need to enter this information in the Sales Tax field, on your Store Settings page.

Note that each State has different rules that may be tied to the count of sales or gross revenue earned from residents of the State. This may mean someone has to pay taxes in a state they don’t have a physical presence in. For example: Iowa Nexus

Please contact support@getbento.com if you believe there is a new law or regulation where taxes are not being calculated correctly for your business.

More info on Taxes: