Configuring and Managing Taxes in the POS

This article explains how taxes are applied to checks, how to configure tax rules in the Dashboard, and how they interact with menu items and reporting.

1. How Taxes Work in the POS

Taxes are applied automatically when the first item is added to a check.

This initial item locks in the tax configuration for the entire check.

Removing the first item does not reset or change the tax behavior.

Tax rules are determined by:

Location-level tax settings

Item-level tax assignments

On-premise vs. online tax categories

2. Setting Up Taxes in the Dashboard

To accommodate different tax rules across jurisdictions, the Dashboard offers a flexible tax configuration interface.

Steps to Add or Edit Taxes

Navigate to the Location Subnavigation.

Click Switch Locations and select the appropriate location.

Go to Settings → Checkout → Taxes.

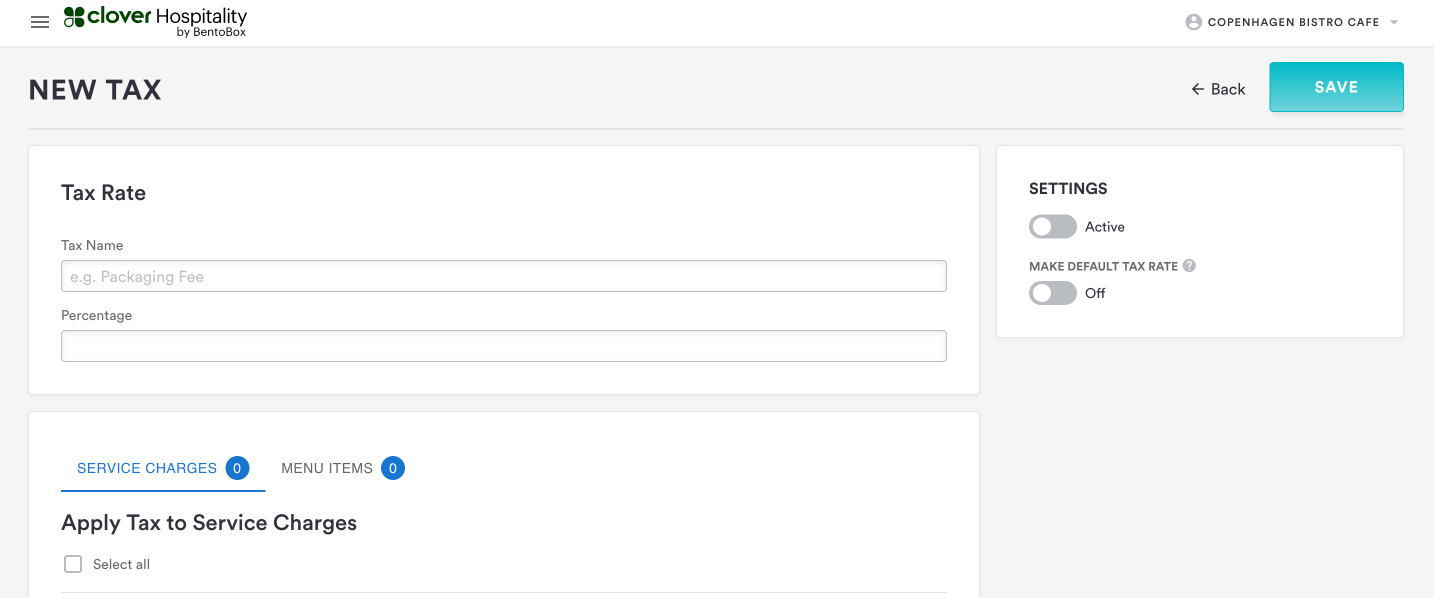

Create a New Tax

Click Add New.

Enter a tax name (this will display on the chit).

Assign a percentage rate (e.g., 5%).

Toggle the tax Active or Inactive.

Optionally, set it as the Default Tax Rate to apply it to all new items and service charges by default.

Click Save.

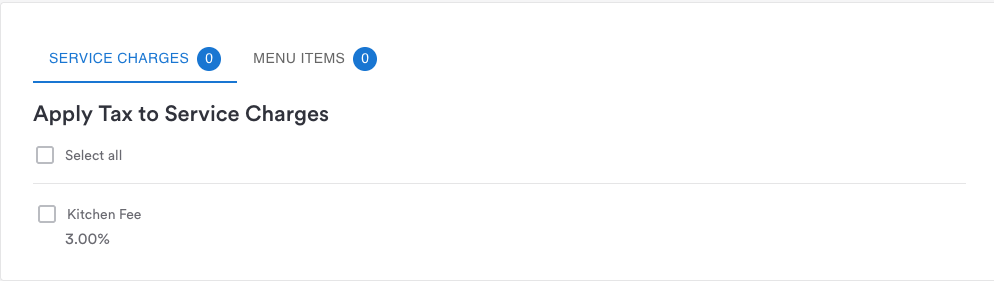

3. Applying Taxes to Items or Charges

Scroll to the bottom of the tax setup screen.

Select specific menu items or service charges to apply the tax to.

This allows for granular control based on item type or business needs.

4. Assigning Taxes to Menu Items

Navigate to the menu item.

Scroll to the Tax Category section.

Assign:

On-premise tax (for in-store orders)

Online tax (for online ordering and online catering)

Save changes.

FAQs – Taxes

Q: When does tax calculation begin on a check?

A: Tax is applied when the first item is added. This locks in the tax configuration for the entire check.

Q: Can taxes be changed after the first item is added?

A: No, the tax behavior is locked once the first item is added to the check.

Q: What happens if a tax or promo code is deleted?

A: Deleted taxes and promo codes cannot be recovered.

Q: Do on-premise and online orders use the same tax settings?

A: No, they use separate tax categories which must be configured individually.

Q: What happens if no taxes are configured in the POS?

A: The system will default to the existing eComm tax set in the Dashboard settings. It will reference the TaxJar rule tied to the store’s ZIP code.